International Comparison of Inheritance Tax System and China’s Choice

The collection of inheritance tax

The inheritance tax originated in ancient Egypt more than 4,000 years ago. The purpose of the levy was to raise military expenses and solve financial deficits. The modern inheritance tax originated in the Netherlands in 1598, mainly to raise funds for war. Generally speaking, the property tax levied in this case is mostly temporary tax, which is mostly abolished immediately after the war, but inheritance tax continues as a fixed tax, and its function orientation has also shifted from raising military expenditure to raising fiscal revenue and adjusting Wealth gap. However, due to the characteristics of high taxation cost and narrow taxation scope of inheritance tax, there has always been a dispute over inheritance tax collection in various countries. As early as 1916, the United States introduced the inheritance tax. After more than a hundred years of development, the inheritance tax in the United States has been preserved in the battle for its existence and abolition.

(1) Basic overview of inheritance tax

At present, more than 100 countries (regions) around the world have levied inheritance tax. Most economically developed countries have levied inheritance tax, but many of them have successively stopped levying inheritance tax, such as Canada and Australia. Most developing countries and countries with backward economic development have not yet levied inheritance tax, and some countries have cancelled it after the levy, such as India and Egypt.

China levied inheritance tax from 1940 to 1949. After the full-scale outbreak of the War of Resistance Against Japanese Aggression in July 1937, the National Government could not cover its expenses. In order to increase fiscal revenue, the National Government promulgated the “Provisional Regulations on Inheritance Tax” in October 1938, and officially implemented the regulations on July 1, 1940. Inheritance tax is levied. After the founding of New China, in order to adjust public-private relations and promote economic recovery and development, the Second National Taxation Conference held in June 1950 decided not to levy inheritance tax for the time being. After the reform and opening up, the controversy over whether to levy inheritance tax still exists. The State Administration of Taxation proposed the idea of levying inheritance tax and gift tax in 1996. The “Outline of the Ninth Five-Year Plan for National Economic and Social Development of the People’s Republic of China” proposes to levy inheritance tax and gift tax gradually. In February 2014, the State Council issued “Several Opinions on Deepening the Reform of the Income Distribution System”, proposing to “study the issue of levying inheritance tax at an appropriate time”. But so far, inheritance tax has not been implemented in our country.

(2) Heritage Tax Collection Codes: Changes in U.S. Inheritance Tax

- History of the U.S. Inheritance Tax

The First World War made the U.S. government unable to pay for it. In order to raise funds for the war, the United States imposed an inheritance tax in 1916. In the original tax system, the estate tax exemption was set at $50,000, and there was a progressive rate of 1% to 10%. In 1924, the United States introduced a gift tax, and unified the tax rate table of gift tax and inheritance tax, in order to fill the loopholes in the collection and management of inheritance tax. The gift tax was abolished in the United States in 1926, but was reintroduced in 1932, and the top marginal rate of the tax was adjusted to 45%. Since then, the system of gift tax as an auxiliary tax of inheritance tax has been established.

In the 1930s, the Great Depression led to a widening of the fiscal gap in the United States, resulting in a large and increasing inheritance tax rate. In 1934 the top marginal rate of inheritance tax was 60%, in 1935 it was raised to 70%, and in 1941 it was raised again to 77%. In 1976, the United States merged inheritance tax and gift tax, and at the same time increased the exemption amount and adjusted the progressive tax rate to 18% to 70%.

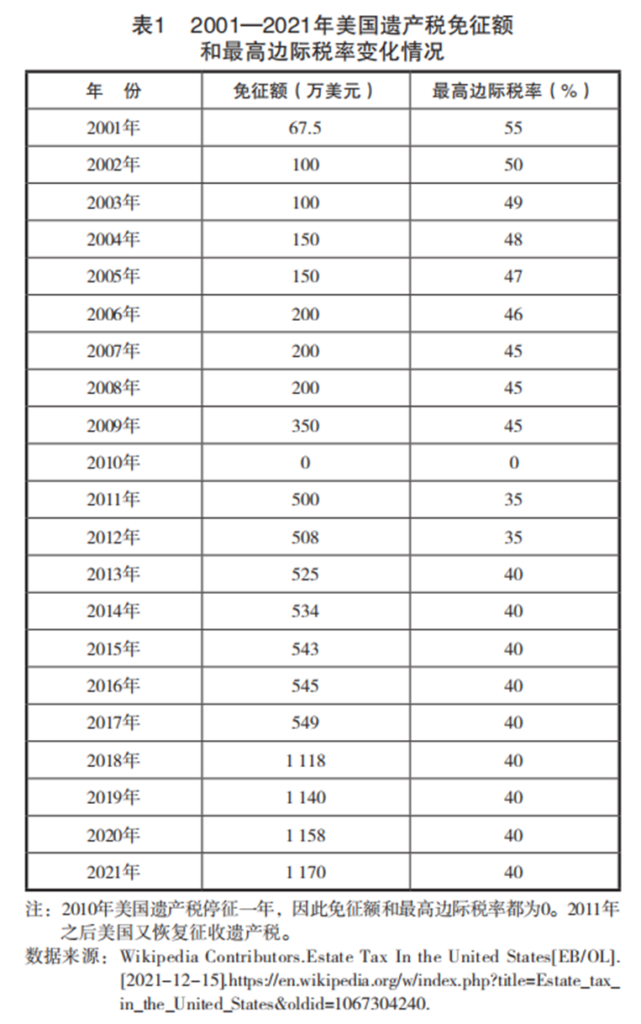

In recent years, the US estate tax exemption has shown an upward trend, while the top marginal tax rate has shown a downward trend, as shown in Table 1.

- The battle for the preservation and abolition of the American inheritance tax

Since 2001, the United States has once again set off a dispute over the retention and abolition of inheritance tax. The Economic Growth and Tax Reconciliation Relief Act of 2001 proposed a plan to abolish the estate tax: first, the top marginal rate of estate tax was lowered from 55% to 45% year by year. From $675,000 in 2001 to $3.5 million annually; second, if Congress does not pass a new law on estate tax before December 31, 2009, the estate tax will be suspended in 2010. That same year, 120 of the top billionaires jointly advertised a petition on the editorial page of The New York Times, asking Congress to keep the estate tax. As a result of the controversy, the bill on estate tax adjustments was not passed. In 2010, the U.S. estate tax was suspended for one year. In 2011, the United States resumed the collection of inheritance tax, increasing the exemption to $5 million and reducing the top marginal tax rate to 35%. The restoration of the estate tax was largely motivated by the consideration of the US economic recovery during the Obama administration.

In 2017, then-President Trump made it clear in the Tax Cuts and Jobs Act that he would repeal the estate tax. Proposals in the U.S. House of Representatives would double the estate tax exemption and plan to repeal both the estate tax and the generation-skipping gift tax in 2025. But the proposal passed by the Senate only retains the content of doubling the exemption, and it will be implemented on January 1, 2018. Between 2018 and 2021, the U.S. estate tax exemption increased slightly, the top marginal tax rate was unchanged, and the U.S. estate tax survived in the battle for survival.

International Comparison and Development Trend of Inheritance Tax System

In the course of its development, inheritance tax has gradually formed a unique tax system and trend. The following briefly introduces the main situation of inheritance tax collection in countries (regions) around the world.

(1) Most countries (regions) implement a sub-inheritance tax system

There are three types of inheritance tax in different countries (regions) in the world: total inheritance tax, partial inheritance tax and mixed inheritance tax. The total inheritance tax system is embodied in the collection method of “tax first and then distribution”. The advantages are that the tax source is reliable, the tax calculation method is simple, the tax collection cost is low, the tax collection and management are convenient, and the efficiency principle is reflected; Intimacy and lack of fairness. The inheritance tax system is embodied in the collection method of “first distribution and then taxation”, which just makes up for the shortcomings of the total inheritance tax system. It treats different heirs differently and adopts different tax rates, which is fair and reflects the principle of quantity can afford; Tax evasion is prone to occur during property distribution, the cost of tax collection and management is high, and the technical means for tax collection and management are also high. The mixed inheritance tax system is embodied in “tax first, then tax distribution”, that is, the same tax object is levied twice. The advantage is that it not only prevents the occurrence of tax evasion, but also reflects the principle of tax fairness. Differential treatment; the disadvantage is that the taxation process is cumbersome, and it is easy to cause repeated taxation.

Most countries (regions) choose to adopt the sub-inheritance tax system, such as the United States, the United Kingdom, Taiwan, etc.; a small number of countries (regions) adopt the total inheritance tax system, such as Japan, France, etc.; only two countries (Iran and Italy) adopt a mixed estate tax system.

(2) The exemption amount and applicable tax rate of inheritance tax change frequently

In the countries (regions) that levy inheritance tax, the exemption amount and applicable tax rate of inheritance tax change frequently. The exemption amount is generally linked to the per capita gross domestic product (GDP). Zhao Huimin and Li Guosheng (2005) used an empirical analysis method to draw the conclusion that the inheritance tax exemption amount is positively correlated with per capita GDP. With the development of economy and the improvement of per capita GDP, the exemption amount of inheritance tax also shows an upward trend.

According to the statistics of inheritance tax rates in 36 OECD member countries based on the World Bank database, among the 25 countries that have introduced inheritance tax, 18 countries adopt excess progressive tax rates, and 7 countries adopt proportional tax rates. Changes in marginal tax rates are also very frequent in countries with excessively progressive tax rates. Overall, countries have been reducing top marginal tax rates and increasing exemptions in recent years. The more typical U.S. inheritance tax system mentioned above, the exemption amount has increased from $50,000 in 1916 to $11.7 million in 2021, showing a trend of increasing year by year; the highest marginal tax rate has dropped from 77% in 1954 to 40% in 2021.

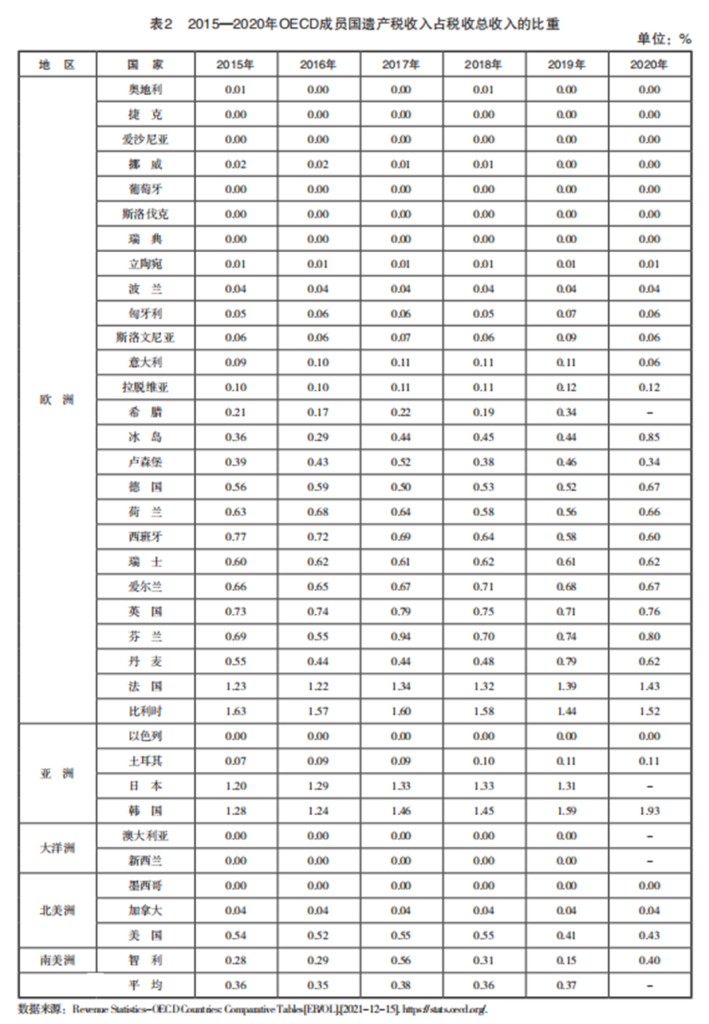

(3) Inheritance tax revenue accounts for a small proportion of total tax revenue

From the perspective of fiscal revenue, the function of inheritance tax to raise fiscal funds is limited. Table 2 shows the proportion of inheritance tax revenue to total tax revenue in OECD member countries from 2015 to 2020. During this period, the proportion of inheritance tax revenue to total tax revenue in OECD member countries was about 0.37% on average. Among the countries (regions) that levy inheritance tax, Belgium, France, Japan and South Korea account for more than 1% of the total tax revenue, and France, Denmark, the Netherlands, South Korea and other countries account for 1% The proportion of inheritance tax revenue in the United States, Spain and other countries in the total tax revenue is on a downward trend.

(4) Setting a gift tax while setting an inheritance tax

Most countries (regions) that levy inheritance tax also levy gift tax, such as Spain, France, Japan, etc.; there are also a few countries (regions) that only levy inheritance tax without gift tax, such as the United Kingdom, Iceland, Singapore, etc.; and Some countries (regions) only levy gift tax, not inheritance tax, such as New Zealand, Bangladesh, etc.

Most countries (regions) apply the same or basically the same tax rate to inheritance tax and gift tax. Only a few countries (regions) have a gift tax rate that is much lower than the inheritance tax rate, such as Bulgaria, Ireland, and Luxembourg; or the gift tax rate is much higher for inheritance tax rates such as Czech and Turkish.

(5) The dispute over the preservation and abolition of inheritance tax

Inheritance tax itself has the purpose of raising fiscal revenue and adjusting income distribution, but due to the impact of collection and administration costs, international tax competition and other factors, it has always been questioned by many scholars, and some countries have even suspended or not levied inheritance tax. In the past 50 years, at least 22 countries (regions) have successively announced the abolition of the estate tax system after imposing the estate tax, such as Argentina, Australia, Malaysia, New Zealand, China Macao Special Administrative Region and Hong Kong Special Administrative Region.

As a world financial center, attracting foreign investment is an important means for the development of the Hong Kong Special Administrative Region of our country. As some countries in the Asia-Pacific region that are also financial centers (such as Malaysia) have successively abolished inheritance tax, the financial community in Hong Kong believes that inheritance tax should also be abolished in order to maintain the region’s share of the global financial market. In 2005, the Legislative Council of the Hong Kong Special Administrative Region passed the Income (Cancellation of Inheritance Tax) Ordinance 2005, officially abolishing inheritance tax, which came into effect on February 11, 2006.

China’s future choices: levying inheritance tax and realizing common prosperity

Common prosperity is the essential requirement of socialism and the common expectation of the people. President Xi Jinping proposed at the tenth meeting of the Central Finance and Economics Committee to promote common prosperity in high-quality development, correctly handle the relationship between efficiency and fairness, build a basic institutional arrangement for primary distribution, redistribution, and coordination of three distributions, and increase Adjustments such as taxation, social security, and transfer payments. The author believes that the collection of inheritance tax can not only promote the establishment and improvement of a modern tax system in my country that matches the modernization of national governance, but also help to promote the three distributions, develop philanthropy, and achieve common prosperity.

(1) Analysis of the necessity and feasibility of levying inheritance tax

- Necessity analysis

First, the collection of inheritance tax is conducive to regulating wealth distribution and maintaining social equity. The “2015 China People’s Livelihood Development Report” shows that the total wealth of the richest 1% of households in my country accounts for 33% of the country’s total wealth, while the poorest 25% of the households own only 1% of the country’s total wealth. It can be seen from the above data that the distribution of wealth in China is uneven, and the wealthy own a large proportion of property. The main role of inheritance tax is to adjust the distribution of wealth and narrow the gap between the rich and the poor. The concentration of huge wealth in the hands of a few can be mitigated by imposing an estate tax, which is an intervention in intergenerational transfers, by taxing the estates of the wealthy.

Second, the collection of inheritance tax is conducive to improving the tax system. From the perspective of China’s tax revenue structure in 2020, turnover tax (including value-added tax, consumption tax and tariff) revenue accounted for 46.26% of total tax revenue, and income tax (including corporate income tax and personal income tax) revenue accounted for 31.10% of total tax revenue %, and other tax revenue accounted for 22.64% of the total tax revenue. China mainly collects indirect taxes, and there is still a big gap in the construction of the tax system with developed countries that mainly collect direct taxes. As an important source of direct tax, inheritance tax is also one of the important types of property tax, which has not yet been levied in China. Therefore, the introduction of inheritance tax can effectively establish and improve the property tax system and improve China’s tax system.

Third, the introduction of inheritance tax is conducive to increasing fiscal revenue. Since the “13th Five-Year Plan”, China has implemented large-scale tax reductions and fee reductions. From 2016 to 2021, the cumulative scale of China’s tax reductions and fee reductions has reached 8.6 trillion yuan. The introduction of inheritance tax can effectively increase fiscal revenue. In addition, the introduction of inheritance tax is conducive to encouraging hard work to become rich, promoting social progress, and at the same time safeguarding national rights and interests and safeguarding taxation sovereignty.

- Feasibility analysis

First, there are sufficient tax sources. The taxpayers of estate tax are mainly high net worth individuals. At present, the scale and wealth of China’s high-net-worth population is huge. The “2020 Hurun Wealth Report” counts the specific scale of high-net-worth households in mainland China. In 2019, the number of households in mainland China with assets of more than 10 million yuan reached 1.61 million, providing a sufficient tax base for the collection of inheritance tax. Second, we can learn from foreign experience. The trend of economic globalization has made international economic exchanges and cooperation closer and closer, and has also built a good communication platform for our country. Many countries (regions) have levied inheritance tax in the last century, and there is rich experience for our country to learn from. China can formulate an inheritance tax system in line with its own national conditions on the basis of learning from the experience and lessons of other countries (regions).

Third, have a good legal environment. Inheritance tax is mainly taxed on private property, and the legitimacy of property is an effective means to ensure the levy of inheritance tax. With the continuous improvement of China’s legal system, the “Constitution”, “Property Law”, “Inheritance Law” and other laws have specially regulated the property ownership system, which has laid a good legal foundation for the collection of inheritance tax.

(2) Problems faced in levying inheritance tax

- China’s personal property information registration system is not perfect

At present, China’s property information registration system is not perfect, and only some personal properties are registered, such as personally owned real estate, vehicles and ships, and stocks of listed companies. There are various forms of heritage, some of which are very concealed, such as calligraphy and painting, antiques, jewelry, cash, etc. It is very difficult to carry out statistical verification of these unregistered estates. Taxpayers may conceal their real wealth when declaring estates, fail to report or underreport, and it is difficult for tax authorities to obtain information on citizens’ estates, which may cause inconsistencies in the process of tax collection and fair management.

- The traditional concept of rejection of inheritance tax

In China, the traditional concept of “children inherit the father’s business” holds that the parents’ property should be inherited by the children, and the imposition of inheritance tax means that the inheritance is “paid”, which is an impact and subversion of the traditional concept. In addition, the family concept of the Chinese people is relatively heavy. The collection of inheritance tax means to divide the inheritance and divide the family property into personal property, which is difficult to obtain the support of traditional concepts.

- Potential for capital outflows

Looking at the current estate tax systems in various countries (regions) in the world, not all estates are taxed, but most of them are taxed on the property that exceeds the exempt amount, which may lead to some wealthy people transferring their property to non-taxable or exempt. Countries (regions) with higher levies lead to capital outflows.

(3) Significance of China’s Inheritance Tax from the Perspective of Common Prosperity

- Contribute to promoting social equity and achieving common prosperity

The “14th Five-Year Plan for National Economic and Social Development of the People’s Republic of China and the Outline of Vision 2035” proposes to improve the direct tax system and appropriately increase the proportion of direct tax. The personal income tax adjusts the income flow gap and is the first line of defense to adjust the income gap; the property tax adjusts the various stock properties owned by people and is the second line of defense to adjust the income gap; the inheritance tax adjusts the intergenerational transfer of property. Taxation and adjusting the unequal distribution of property stock are the third line of defense for adjusting income gaps. Inheritance tax has the function of wealth redistribution and can promote the supply of public goods and services. Due to the progressive nature of inheritance tax, the introduction of inheritance tax can raise more funds for public services, social security, etc., and improve the national welfare system. In addition, inheritance tax is a powerful supplement to the adjustment function of personal income tax, a means of wealth redistribution, and plays an important role in narrowing the gap between the rich and the poor and promoting social equity.

- Contribute to the promotion of charitable donations, improve and promote the three distributions

According to the “2019 China Charitable Donation Report”, the total amount of charitable donations in China in 2019 reached 170.144 billion yuan, accounting for 0.17% of China’s GDP; during the same period, the scale of charitable donations in the United States accounted for 2% of GDP. In contrast, China’s charitable donations are still at a low level. The development of charitable causes cannot be separated from the promotion of tax policies. Inheritance tax plays a guiding and encouraging role in charitable donations. Judging from the situation of other countries (regions) that have levied inheritance tax, deductible systems have been designed for charitable donations. In the design of the inheritance tax system in China, preferential tax policies such as pre-tax deduction and tax exemption are also formulated for charitable donations, thereby reducing the cost of individual donations and guiding more high-income earners to turn their assets to donations to charitable causes. This will help improve China’s welfare donation system and achieve three distributions.

(4) Suggestions on the overall design of my country’s inheritance tax system

- The total inheritance tax system is adopted in the early stage of collection

As mentioned above, the inheritance tax system can be divided into three categories: the total inheritance tax system, the sub-inheritance tax system and the mixed inheritance tax system. As far as China’s actual situation is concerned, at the beginning of the collection of inheritance tax, it can be considered to refer to the practices of the United States, the United Kingdom and other countries, and adopt the collection model of the total inheritance tax system, that is, to tax the entire inheritance of the deceased, rather than distribute the inheritance to the heirs. The tax is then levied for the following reasons.

First of all, the supporting system of tax collection and management corresponding to the inheritance tax in China is not perfect. The adoption of the total inheritance tax system can reduce the cost of collection and management, and at the same time, it is also convenient for collection and management. Secondly, due to the strong commonality of family property in China and the prominent concealment of inheritance, the adoption of the total inheritance tax model can effectively grasp the total amount of inheritance and avoid the loss of tax sources.

- Set a high exemption amount and implement excess progressive tax rate

Inheritance tax is positioned as a “tax on the wealthy”. The scope of its taxation should focus on controlling a few wealthy families. Therefore, the setting of the exemption amount is particularly important. An excessively low exemption amount will lead to an overly wide coverage of the inheritance tax, which may lead to too many taxpayers, which will lead to the weakening of the inheritance tax’s ability to adjust wealth distribution and the difficulty of tax collection and management, etc. China defines a high-net-worth individual as an individual with a net worth of more than 10 million yuan. It is recommended to set the inheritance tax exemption amount to 10 million yuan. This is in line with the requirements of the scope of inheritance tax collection in China. On this basis, the exemption amount can be adjusted continuously with the rise of the inflation rate.

There are mainly two types of tax rates: proportional tax rates and excess progressive tax rates. In comparison, if the proportional tax rate is adopted, the method of calculation and collection is simple, and the principle of tax efficiency is more important; if the excess progressive tax rate is adopted, the adjustment effect is stronger, which reflects the principle of taxation based on quantity and capacity, and pays more attention to the principle of fair taxation. The main purpose of China’s inheritance tax is to narrow the gap between the rich and the poor, and the excess progressive tax rate can better reflect the fairness of taxation and is conducive to the role of taxation in regulating wealth redistribution.

- Inheritance tax and gift tax are collected together

Judging from the international practice of inheritance tax, most countries (regions) adopt the mode of co-collection of inheritance tax and gift tax, the main purpose of which is to prevent taxpayers from transferring inheritance by means of gifts. There are two kinds of relationship between inheritance tax and gift tax: one is the combined taxation of the two, the total amount of donations and the total inheritance of the deceased are summed up, and the cumulative inheritance tax is collected; gift tax.

Judging from the situation in China, it is more reasonable to combine inheritance tax and gift tax. Inheritance tax is already a new tax. If another gift tax is levied, it will increase the tax burden of taxpayers. At the same time, the combination of inheritance tax and gift tax will also help simplify the tax system. The estate tax is levied on the taxable income of the conferred property that is included in the estate tax.

- Further improve the construction of the tax legal system

The collection of inheritance tax should follow the principle of legal taxation. Combined with the experience of inheritance tax legislation in other countries (regions) that collect inheritance tax in the world, China should also formulate an “inheritance tax law” in line with its national conditions to provide a legal basis for the collection of inheritance tax. The allocation of legislative power should also be fully considered, the division of tax power between the central and local governments should be improved, and the ownership of inheritance tax income should be divided. Legislation of inheritance tax will help to further improve the taxation legal system, strengthen the construction of the rule of law in taxation, and improve the efficiency of collection and management.

Conclusions and Inspirations

Since the reform and opening up, China’s economy has moved from a stage of high-speed development to a stage of high-quality development, but the gap between the rich and the poor is an issue that cannot be ignored, and the intergenerational transfer of property will likely further widen the gap between the rich and the poor. In the process, an inheritance tax will be levied. It can reduce the impact of wealth in the process of intergenerational transfer and effectively narrow the gap between the rich and the poor. The Fourteenth Five-Year Plan for the National Economic and Social Development of the People’s Republic of China and the Outline of the Vision for 2035 put forward the requirements of optimizing the tax system structure and improving the direct tax system and other requirements to improve the modern tax system, which also laid the foundation for the establishment and improvement of the inheritance tax system. From the perspective of international trends and international experience, although some countries have been fighting for inheritance tax collection, the collection of inheritance tax is still a common choice in developed countries. China now has the macroeconomic conditions to levy inheritance tax. By learning from the successful experience of developed countries in levying inheritance tax and improving its unreasonableness, we can adopt a positive and stable inheritance tax system design and timely promote inheritance tax based on China’s actual national conditions.